Nitin Spinners: Transition from Yarn to Fabric?

The company is doing 1,000 Cr of capex - Spinning Rs 400 Cr and Fabric - Rs 550 Cr (Higher margin business)

About Company

Founded in 1992 in Bhilwara of Rajasthan, Nitin Spinners is India’s leading manufacturer of cotton yarn, knitted fabrics and finished woven fabrics.

Textile Industry Analysis

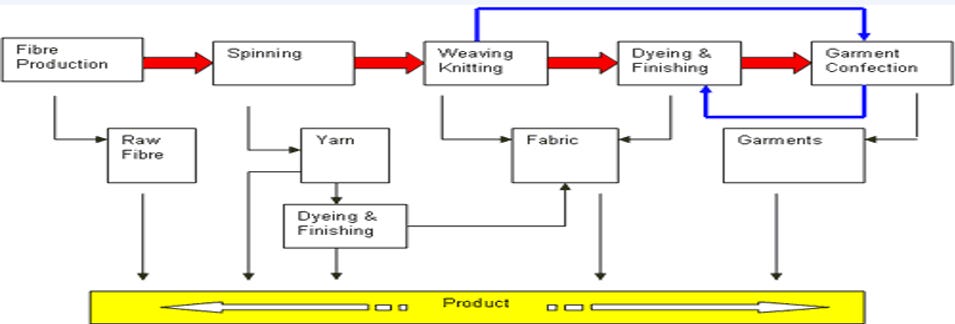

Textile value chain has mainly 4 parts-

1) Fibre Production: Textile fibers are categorized as natural (mainly cotton, with alternatives like hemp, banana, and lotus) and manmade (synthetic like polyester, acrylic, nylon; and cellulosic like viscose). Globally, 65% of yarn is manmade, whereas in India, cotton makes up 70% due to favorable taxes and abundant supply.

2) Spinning (Yarn Production): Spinning mills convert natural or manmade fibers into yarn, specializing in cotton, synthetic, or blended yarn based on demand.

3) Fabric Production (Knitting/Weaving): Fabric makers convert yarn into cloth, primarily for B2B sales to garment manufacturers. Some brands (e.g., Raymond) sell fabric directly to consumers.

4) Garment Manufacturing & Retail: The final stage involves turning fabric into garments. Some companies only manufacture or retail, while others handle both steps.

Key Characteristics of Textile Industry-

The textile industry is largely characterized by commodity products in segments like spinning and fabric-making, where goods are standardized and highly substitutable, leading to intense competition and low differentiation. While most yarn and fabric are commoditized, some players create value by producing premium or specialized varieties, like compact or mélange yarn, which can command slightly higher prices. Similarly, certain fabric producers who offer premium quality or create B2C brands (e.g., Raymond Ltd) can achieve better margins.

Competitive and highly fragmented industry, with many small players.

For example, in spinning, India's significant spindle capacity remains distributed among small mills, with even the largest player holding only a 3% market share.

Given the commoditized nature and intense competition, profit margins remain modest. Average net profit margins for spinning mills are about 1%, with fabric and apparel margins around 3%.

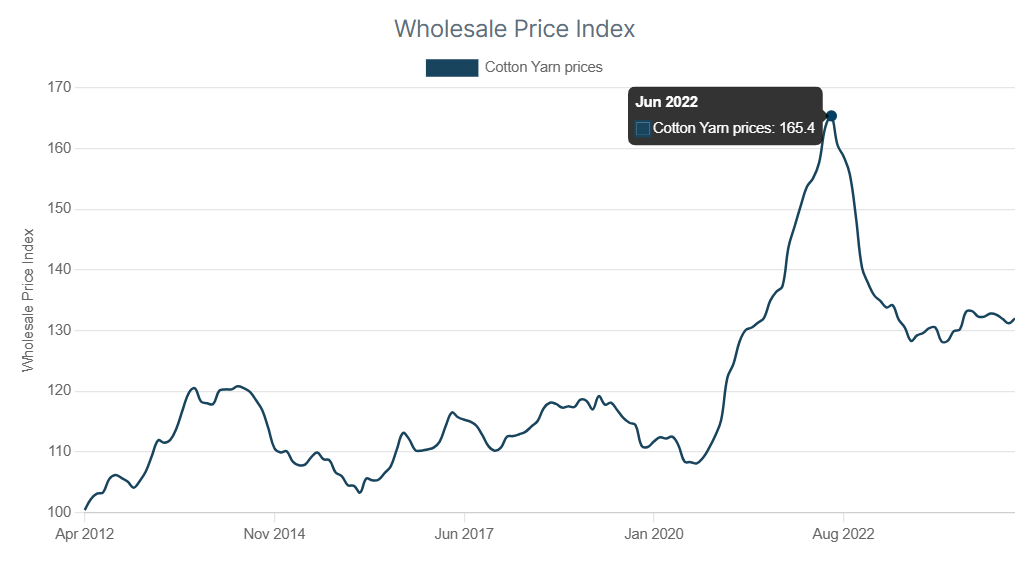

Impact of Raw Material: The textile industry is highly raw material-intensive, with cotton and manmade fibers making up around 60% of operating costs. Cotton-spinning mills are most vulnerable to price fluctuations due to their reliance on seasonal cotton procurement and low pricing power. Fabric and apparel manufacturers are less affected, as they price products based on current raw material costs and produce against confirmed orders.

Economies of Scale: Smaller players face a competitive disadvantage due to intense price-based competition, raw material price volatility, and limited capacity. Larger companies can secure more stable customer bases and higher profit margins, especially when catering directly to big international brands.

Capital and Working Capital Intensity: The textile industry, especially in spinning and fabric manufacturing, is highly capital-intensive, requiring significant investments in plant, machinery, and working capital for raw materials and inventory. Spinning mills are particularly capital-intensive, with a fixed asset turnover ratio of 1.

Seasonality and Price Volatility: The cotton yarn spinning segment faces challenges due to the seasonality of cotton availability and price volatility, leading companies to stock large amounts of cotton during the harvest season, and exposing them to inventory losses if prices decline.

Modernization and Energy Demands: Regular equipment modernization is necessary to maintain efficiency, making it an additional capital burden for textile mills. Furthermore, textile manufacturing, particularly spinning mills, is energy-intensive, requiring substantial power to operate. Power costs are about 10% of revenue for spinners.

Business Analysis

The company operates in two segments; one is Yarn manufacturing and the other is Fabric manufacturing.

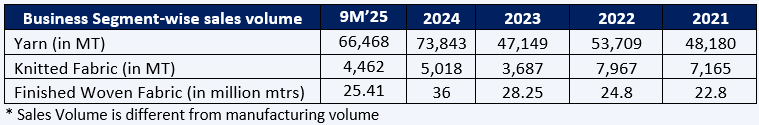

Business Segment- Sales Volume:

In 2024, the company has completed the capex of Rs 955 Crs to expand capacities in all the segments. As mentioned in the industry analysis, the asset turnover is 1-1.3 in the textile industry.

If we calculate Segment Revenue/Segment Volume, we can track the average realization in the last 4 years-

We can clearly observe that Yarn realization is highly dependent on the demand of end-use. In 2022 demand was very good and EBITDA Margin was around 24%, but it was not sustainable.

Management mentioned it in Q1’25 Concall-

“We had a 20%-25% EBITDA margin, that was only, I think, once in 2021-22. And that was an extraordinary situation where the demand was very good. And accordingly, the prices were higher all around the world.”

Cotton to Yarn Spread- Serves as a profitability lever for spinners, with wider spreads indicating potential revenue growth and narrower spreads indicating potential revenue pressures.

Management comment in Q1’25 Concall-

“The cotton-to-yarn spread is about INR100 a kg at this point of time for the average of 30 counts.

Last year, in the same quarter, it was at about INR86-INR87. Now it has moved from INR86-INR87 to INR100.

In Covid, around Rs 75. At peak, it was around Rs 130-135 in 21-22.”

Future Outlook

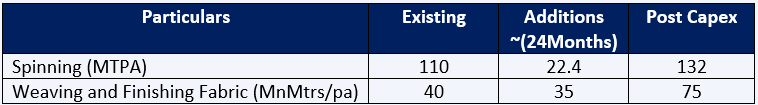

The company is incurring Rs 1,100 Crores of capex (Debt: ~Rs 800 Crs || Remaining: Internal Accruals). Capex will be completed by Dec’26.

Capex Details:

Spinning: Additions of approximately 66,096 Spindles with a production capacity of 22,400 MTPA

Fabrics: Additions of 240 Airjet/Rapier Looms along with Dyeing, Finishing capacity, and Yarn Dyeing Facilities

Renewable Power Capacity: Adding 14MW(DC)/11MW(AC) – Renewable Solar Power Capacity

The company will clock around 33% of the revenue from the Fabric business which has better margins and 60% of yarn produced will be used for fabric activity.

Key Risks

Cotton prices directly impact the margins for the spinning industry

Margins are directly linked to the end-use demand of the product

Any Tariffs on the industry could adversely impact the company

Why do we find this company interesting?

Consolidation in the Spinning Industry

Management commentary in Q3’25 Concall- “The spinning industry especially is passing through one of its rough phases, where a lot of consolidation is happening. We have seen a lot of smaller capacities to the tune of -- if you talk about the total capacity, about 12% to 15% of the spinning capacity is already closed or on the verge of closures.”

Bangladesh Situation favoring India

Management commentary in Q3’25 Concall- “also the new -- because of their capital crunch, the new investments also have stopped, especially on the back end of spinning and fabric manufacturing, which they were doing in a big way during 2019 to 2022, '23.”

Spinning Margins at the lower end from the last couple of years

Conclusion

We expect the company should report around EPS of ~Rs 55 in FY’28 and should have 33% of the revenue from the Fabric business. But, there is no immediate trigger for the company at least for the next 12-15 months.

Management has also indicated the foray into the garments business if the government provides any PLI benefits, but it remains an optionality for the company.

Disclosure

We do not have any substantial holdings in the company. But we are tracking the business closely.

See you next time.

Until then… Share your views in the comments!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice