ITC Hotels- A Special Situation?

Investors may get a good opportunity in ITC Hotel, a special case discussed at the end!

ITC Limited is demerging ITC Hotels in a ratio of 1:10, meaning that for every 10 shares of ITC Limited held, shareholders will receive one share of ITC Hotels.

Eligibility Date: 3rd January 2025 (Last date of buying ITC shares to get ITC hotel shares)

Record Date: 6th January 2025

ITC Hotels is a wholly owned subsidiary of ITC Limited. Following the demerger, ITC Limited will retain a 40% stake in the company, with the remaining 60% being held by shareholders.

ITC Limited will transfer cash and cash equivalents worth ₹1,500 crore. To support the growth and contingency requirements of ITC Hotels.

About ITC Hotels-

ITC Hotels is the second largest hotel company in India, boasting approximately 140 hotels and 13,000 rooms as of October 24, 2024.

ITC Hotels employs an "asset-right strategy" to expand its hotel portfolio while minimizing capital expenditure and operational risk. This strategy is implemented through a mix of ownership and management models. Approximately 35% of the hotel portfolio is owned by ITC Hotels, while the remainder comprises managed and franchised properties.

ITC Hotels gets into management contracts with real estate developers, where the developer retains ownership of the property, and ITC Hotels undertakes the renovation and management of the hotel.ITC Hotels operates its hotels under various brands, including:

● ITC: Featuring monumental properties like ITC Royal Bengal, ITC Maurya, and ITC Grand Chola.

● Mementos by ITC: Offering boutique properties, an example being Udupi's beautiful property.

● Welcome Hotel: Catering to a different segment of the market.

● Storii: A collection of handpicked boutique properties.

● Fortune: Includes three and four-star properties for both leisure and business travelers.

The Company’s first international property ITC Ratnadipa, opened in April 2024 in Colombo, Sri Lanka

Future Growth:

The company plans to add another 28 hotels in the next 24 months.

The company aims to grow its portfolio to 200 hotels and 18,000 rooms by 2030.

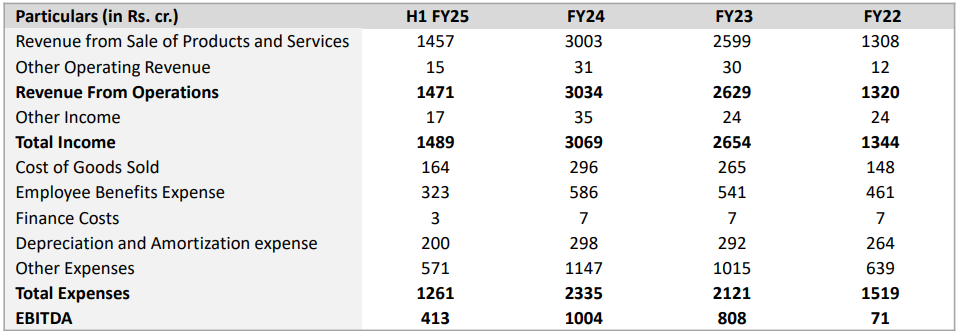

ITC Hotels Financials:

The company is well-positioned financially with no debt on the balance sheet and ₹1,500 crore in cash and cash equivalents.

The company typically generates 60% of its annual revenue in the second half of the financial year, suggesting ITC Hotels could achieve approximately ₹3,500 crore in revenue for FY25.

FY’25E Revenue = Rs 3,500 Cr

FY’25E EBITDA = Rs 3,500 * 33% = Rs 1,155 Cr (assuming EBITA Margin = 33%)

What could be the potential Mcap of ITC Hotels?

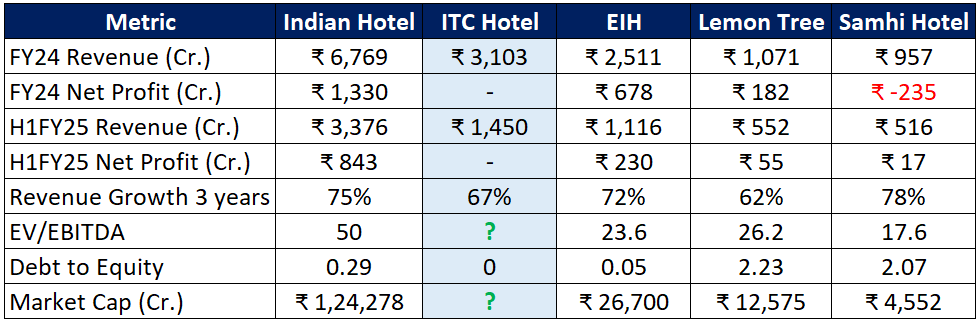

To estimate the potential market capitalization of ITC Hotels, we should analyze its competitors and use the EV/EBITDA multiple for comparison.

In the hotel industry, depreciation tends to be significant due to substantial investments in assets like buying properties and renovation costs.

As a result, the P/E ratio is not an ideal metric for comparison. Instead, EV/EBITDA is a more appropriate metric, as it accounts for operating performance without being skewed by non-cash expenses like depreciation. This provides a clearer view of the company’s operational efficiency and profitability relative to its peers.

Considering the quality of ITC as a promoter and its strong brand value, we believe the company deserves an EV/EBITDA multiple in the range of 30-35.

Enterprise Value (EV) = EV/EBITDA multiple * EBITDA

and, Market Capitalization = EV + Cash and Cash Equivalents - Total Debt

No. of outstanding shares in ITC Hotels post demerger = 2,08,11,71,039 (208.11 Cr)

FY’25 E EBITDA = Rs 1,155 Cr (calculated above)

Cash Equivalents = Rs 1,500 Cr

Total Debt = 0

Using the different EV/EBITDA numbers, we will try to estimate the Mcap and Fair value of ITC Hotels-

What happened with Jio Financial Services after it was listed could happen with ITC Hotels?

When Jio Financial Services was listed at ₹261 per share, its price fell for several days reaching ₹215 per share. This was because index funds and ETFs that tracked indexes like Nifty 50 already held shares of Reliance Industries and when Reliance Industries announced a 1:1 share distribution of Jio Financial Services for Reliance Industries shareholders, index funds and ETFs received shares of Jio Financial Services too.

However, after the demerger, Jio Financial Services was excluded from Nifty 50 and index funds had to sell their shares in Jio Financial Services, which led to selling pressure.

Because ITC Hotels will also be excluded from large-cap indexes, a similar selling pressure from index funds is anticipated. All index funds and ETFs that follow the Nifty 50 or Nifty 100 index will get 1 share of ITC Hotels for every 10 shares of ITC Ltd. they hold.

Keep an eye on who is buying those shares, because if the price falls below ₹150 per share, this could be a good buying opportunity.

See you next time.

Until then… Share your views in the comments!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice.