Bansal Roofing: A commodity Business?

110 Cr Mcap company having potential to 2x sales in next 2-3 years due to strong sectoral tailwind

About the company

“Bansal Roofing Products Limited” (BRPL) started in the year 2008 by manufacturing Roofing Sheets and Roofing Accessories and was listed on the BSE-SME platform on July’2014 and migrated to the mainboard BSE on Dec’2021.

The company started manufacturing Pre-Engineering Buildings in 2016, making 95% of PEB components in-house.

What is PEB?

Pre-engineering buildings are modern construction systems where building components are pre-designed, pre-fabricated, and then assembled on-site. PEBs use steel structures that are fabricated off-site in factories, which are then transported to the construction site for assembly.

Advantages of PEBs-

Lower construction and maintenance cost

Shorter construction time as PEB components to be manufactured off-site and quickly assembled on-site (30-40% faster than traditional construction)

PEBs can easily be expanded or modified by adding additional bays or building extensions

PEB structures are durable, with steel providing strength and resistance to weather

Industry Overview-

The Indian PEB market is expected to grow steadily at a rate of around 12-15% annually over the next five years due to government push for infrastructure development.

Penner Industries one of the listed companies is growing revenue by 30% YoY in the PEB segment.

Some key pointers for the PEB industry-

As of today, PEBs are seen as suitable only for industrial buildings like warehouses, and factory sheds. Increasing adoption in commercial and residential spaces remains a challenge.

High dependency on Steel prices as Steel is a core material for PEBs

Requirement of Skill and Unskilled Labour

Transportation costs may restrict PEB companies from capturing projects after a certain distance from their production facilities, where logistics and costs become unfeasible.

Business Analysis-

As of FY’24, company revenue is 105 Cr growing at a CAGR of 37% in the last 3 years.

In 2020, company have acquired new unit i.e. Unit 2 (2,97,000 sq.ft) which was almost 15x the size of Unit 1(20,000 sq.ft). (Source- BSE India) for Rs 3.61 Crores.

Company had guided to construct Unit 2 in five phases to increase the capacity of PEBs to 2,000 MT per month in the next 3 years.

Company in the recent concall mentioned that all the operations are moved to Unit 2 and Unit 1 is unoperational and it will give on monthly rent for Rs 3.15 lakhs.

The contribution of PEB to revenue is increasing on a yearly basis, the gross margin in PEB is around 15-20% whereas roofing products have a lower gross margin (5%).

In the Q4’24 concall, management mentioned that Revenue has declined in spite of an increase in production capacity/tonnage due to a decrease in prices of steel. In Mar’23, prices of steel were around Rs 80 whereas Rs 57 in Mar’24.

Company also mentioned that they have taken the following steps to mitigate labor issues-

Provided accommodation facilities for around 80 laborers by constructing 16-18 houses

Started canteen services

Company trying to sign MOUs with Industrial Training and Skill Development centers

BRPL follows International Design Standards to manufacture steel buildings.

BRPL Clientele

Company has catered to more than 1,200 customers and has long-term relationship with L&T, Deepak Nitrite, Aarti Industries, ABB Limited, and Alembic Limited. Recently added Adani group.

Highest SME Credit Rating by Crisil

Company has been rated MSE 1 by Crisil since Dec’2019.

Financial Analysis

Company has been able to maintain avg ROE of 16% and avg ROCE of 16% in last 9 years which means the company is creating value for its shareholders.

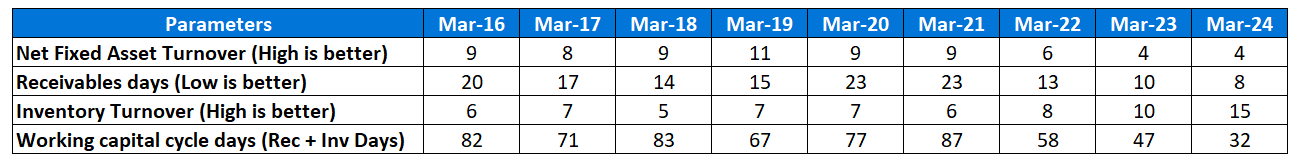

Key parameters to assess operational performance-

Net Fixed Asset Turnover = Sales/average of net fixed assets at the start and end of a financial year. High NFAT represents that the company is able to use its fixed assets in a very efficient manner. Post Mar’22, NFAT has decreased due to capex done by a company and it still needs to materialize in upcoming years

Receivable days = 365/(Sales/average of account receivables at the start and end of the financial year). Lower Receivable days mean that the company is not giving higher credit periods to customers to generate sales.

Inventory Turnover = Sales/average of inventory at the start and the end of the financial year. Lower inventory turnover means that the company is accumulating a lot of inventory, which might become obsolete later. BRPL has been maintained. Company has maintained avg inventory turnover of 8 where as Pennar Industries has avg inventory turnover of 4.

Working capital cycle days (exc. payable days) = Sum of receivables days and inventory days. It does not take into account payables days as otherwise companies can easily mask poor working capital position by delaying the payment to suppliers/vendors. BRPL has maintained it for under 3 months (90 days) which screams efficiency.

Last 3 years’ avg Debt to equity = 0.3 (Represents company has not leveraged its balance sheet for capex)

Company has grown sales at a CAGR of 18% in the last 10 years and 37% in the last 3 years while maintaining the operating profit margin at around 7% in a cyclical industry.

Management

Kaushal Gupta, Chairman and Managing Director, has over 30 years of experience in the industry. His son, Kailash Gupta, has also joined the company, reflecting continued promoter interest and succession planning.

Currently, the promoters hold around 75% of the company's stake, indicating strong "skin in the game," aligning their interests with the long-term success and growth of the company.

Management Remuneration-

Total Remuneration (in Rs) has increased over the year.

Management Overambitious Targets and Compliance Lapses-

Management has overcomitted in the past mentioning its revenue to reach 100 Cr by FY18 in its listing ceremony.

Company faced a compliance issue with Capital and Disclosure Requirements in 2018

Key Risks

Revenue and profitability are directly dependent on steel prices.

It is a commodity business with low barriers to entry, everything depends on the operational efficiency.

Geographic Risk as most of the revenue is coming from Gujarat

Technicals

Stock has been consolidating for the last 3 years and hasn’t done much. Rs 70-75 is acting as a strong support zone.

Why do I find this company interesting?

Sectoral Tailwind- Company can 3x their sales in the next 2-3 years.

Capacity Expansion - PEBs have higher gross margins and increasing their share in revenue will lead to a disproportionate increase in PAT

Prudent and Efficient management- Effective management of working capital shows strong operational efficiency, indicating the company can efficiently handle cash flow, inventory, and receivables.

Low Float - 73.38% of the stocks held by promoters

Let’s do a back of envelope calculations-

In the Q4’24 concall, management mentioned the following information-

Average Revenue per Tonnage = Rs 0.034 Cr

Current Capacity = 800 tonnes per month + Completion of Phase 3

Assumed Capacity for calculation = 1000 tonnes per month

Assuming Capacity Utilisation = 70% and PAT margin = 3.6% (Last 10 yrs avg. PAT Margin = 4%)

Estimated FY’26 Revenue = (1000 * 12 * 70% * 0.034 ) = Rs 285.6 Cr

Estimated FY’26 PAT = Rs 10.28 Cr

Disclosure

I have been holding this stock from Rs 77 and may average up based on momentum in business or exit if the thesis doesn’t play out in the next 12 months.

See you next time.

Until then… Share your views in the comments!

Disclaimer: This article is provided for informational purposes only and should not be considered as an investment advice

Thanks a lot for a detailed industry overview and thorough analysis of the company

Revenue north of 2 Lkh per ton seems too high, can you cross check?

Because steel prices are usually in the range of 50 to 70 per kg, value added by such business must not be more than 35%.

That should make it something like 67 to 94 per kg.

and if we convert that to ton,

67 per kg to ton= 67*1,000=67,000 per ton or

94 per kg to ton= 94*1,000=94,000 per ton

how company is making north of 2lakh per ton?

let me know if I m mistaking somewhere while calculation.

Thanks & Regards,

Kalpesh Mahajan